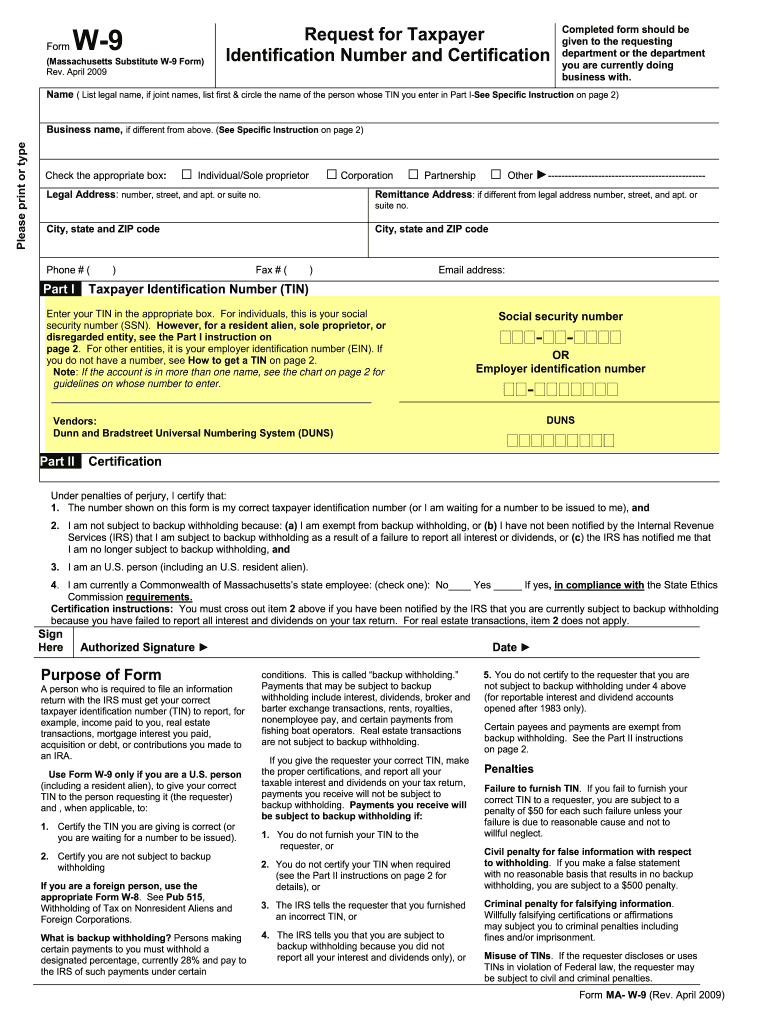

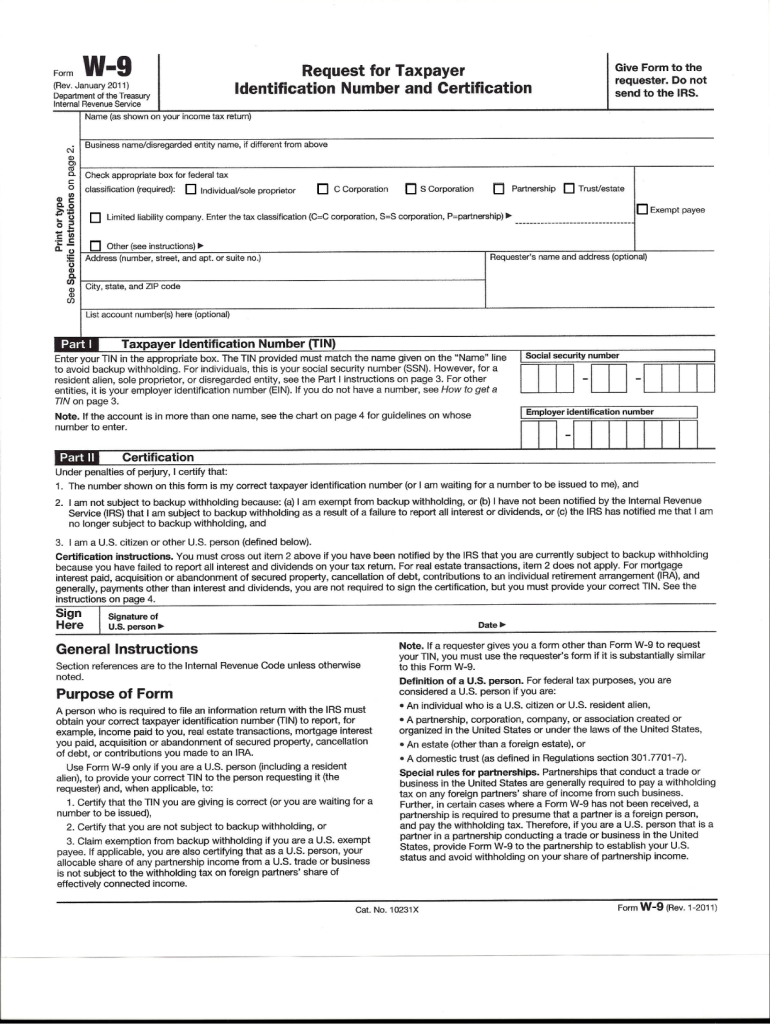

The Act contains provisions covering the electronic filing of tax returns verified with eSignatures.

#W 9 PDF SIGNATURE CODE#

The RRA includes multiple amendments to the Internal Revenue Code of 1986. Subparagraph 3 governs that taxpayers' eSignatures shall be accepted in relation to “any request for disclosure of a taxpayer's return or return information to a tax practitioner or any power of attorney (POA) granted by a taxpayer to a tax practitioner.” This means electronic signatures are viewed as legally valid for disclosure authorizations to tax practitioners.

Section 6061 of the Internal Revenue Code stipulates the use of electronic signatures for tax returns and other documents. Does the IRS allow the use of eSignatures? The RRA contains provisions related to individuals and businesses, the structure and functioning of the IRS, taxpayer rights, and more. The Internal Revenue Service Restructuring and Reform Act (1998), also referred to as RRA, or the Taxpayers Bill of Rights III improved the organizational culture of the IRS and enhanced taxpayer rights and protections. It codifies multiple forms of federal tax laws, including income, payroll, estate, gift, excise, alcohol, tobacco, and employment taxes along with procedure and administration. The Internal Revenue Code (IRC), previously the Internal Revenue Code of 1986, is the primary statutory basis of the federal tax law in the United States. Which laws govern the use of eSignatures for tax services in the US? Today, both acts together with state laws and regulations, govern the use of eSignatures in the US. All of this inevitably led to the adoption of the UETA (1999) and the ESIGN Act (2000). The rise of electronic commerce in the mid-1990s accelerated the enactment of laws stipulating the use of eSignatures.

Back then, the tax authority sent out postcards with an e-file customer number (ECN) to about 12 million taxpayers instead of the paper-based tax booklet. In 1998, the IRS attempted to streamline the use of eSignatures for tax filing. A decade later, in 1997, approximately 15 million taxpayers filed their federal income tax returns in electronic form. Starting from 1986, the Internal Revenue Service (IRS) offered an electronic filing option to the increasing number of taxpayers. In the late 1980s and early 1990s, faxed signatures became legally enforceable in legal and administrative proceedings by state and federal agencies. In 1869, the New Hampshire Supreme Court was the first to verify the enforceability of an eSignature submitted via telegraph.

One of the first instances of using an electronic signature in the United States dates back to the mid-nineteenth century.

0 kommentar(er)

0 kommentar(er)